It is essential to make sure that the a person charging VAT (value added tax) in registered with FTA and a valid TRN ( Tax Registration Number)

It is a 15 digit numeric number ending with number "3". TRN is key for all communication between taxable persons and Federal Tax Authority. It serves as the unique identification factor and used in communication such as Invoices , Credit Notes , Tax Filing , Tax Audit , Tax Hearing ,

If your taxable income for the past 12 months exceeds AED375000 , You must apply for a TRN as per the timeline specified.

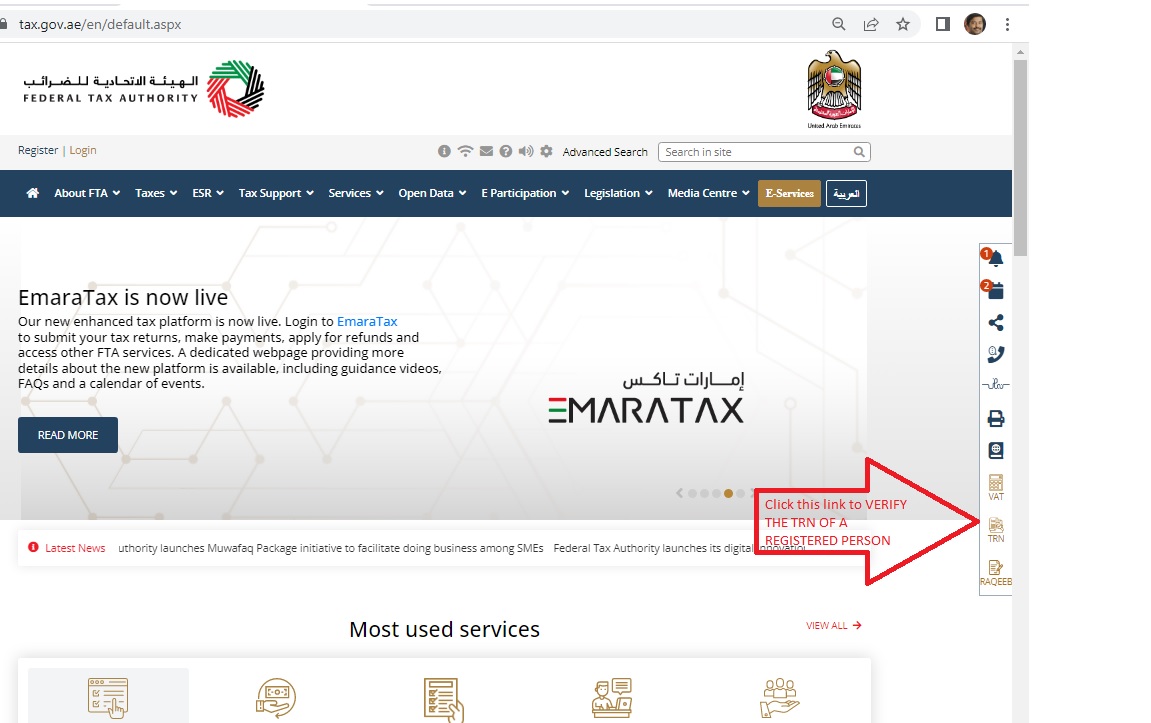

To verify the correctness of a TRN , you may follow the link below and click the TRN icon on your right hand side of the screen (refer to the image above)

https://tax.gov.ae/en/default.aspx

#trnverification #uaetrnverification #howtoverifyatrn #capsaccounting #accountantindubai #professionalaccountant #accountantnearyou #auditorindubai #vatconsultantindubai